Market Rebound Following Positive Data and Trade Deal

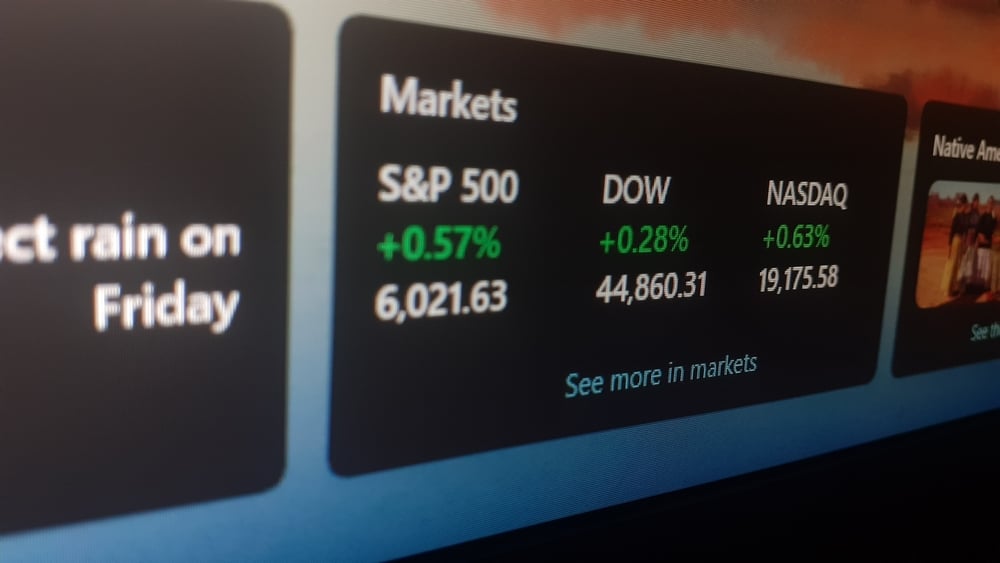

Stocks soared on Tuesday as investors cheered softer-than-expected inflation data and a 90-day pause on U.S.-China tariffs. The S&P 500 and Nasdaq posted significant gains, while the Dow Jones Industrial Average saw a decline due to a slump in UnitedHealth’s shares. The positive sentiment came after the U.S. and China agreed to dial back reciprocal tariffs, helping alleviate concerns about the economic impact of the trade war.

Inflation Data Fuels Optimism

The S&P 500 closed with a year-to-date gain for the first time since late February after the U.S. reported that consumer prices increased by just 0.2% in April, lower than the expected 0.3% rise. Year-over-year inflation climbed to 2.3%, down from 2.4% in March. Carol Schleif, Chief Market Strategist at BMO Private Wealth, expressed optimism, noting that the inflation data was in line with expectations and that the trade truce between the U.S. and China provided further positive momentum for the markets.

Positive Impact of US-China Trade Truce

The trade truce between the U.S. and China, announced on Monday, has provided a much-needed break from the escalating trade tensions. The U.S. will lower tariffs on Chinese imports to 30%, down from 145%, and China will reduce its tariffs from 125% to 10%. This temporary relief has raised hopes for a reduction in trade-related economic pressures and improved market sentiment.

Federal Reserve’s Next Move in Focus

With inflation showing signs of slowing and trade relations improving, investors are increasingly betting that the Federal Reserve will hold off on cutting interest rates until September. Analysts also expect two 25-basis-point cuts by the end of the year. The Fed’s stance on interest rates is likely to remain a key factor for the markets, with many anticipating that slowing inflation will allow the central bank to act more flexibly in the coming months.

Tech Stocks Lead Gains

The technology sector was a standout performer, with the Nasdaq gaining 1.61%, led by strong performances from companies like Nvidia, Apple, and Tesla.

Walmart’s Upcoming Earnings and Fed Speeches

As the earnings season continues, investors will keep an eye on retail giant Walmart’s quarterly report, scheduled for later this week. Additionally, several Federal Reserve officials, including Chair Jerome Powell, are set to speak, providing further insights into the central bank’s future policies and their potential impact on the markets.

Stock Market Activity and Market Breadth

On Tuesday, advancing issues outnumbered decliners on both the NYSE and Nasdaq. The S&P 500 recorded 19 new 52-week highs, while the Nasdaq saw 75 new highs. Total trading volume on U.S. exchanges reached 17.81 billion shares, above the 16.51 billion average for the last 20 sessions, indicating strong market participation.