After years of underinvestment, uranium is back at the center of the clean energy transition. Microsoft (NASDAQ: MSFT) has taken a clear step forward, becoming a member of the World Nuclear Association, the global organization that connects policymakers, utilities, and suppliers shaping the future of nuclear power.

Big Tech now sees nuclear energy as essential infrastructure for the AI era. While Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOG) are also pursuing nuclear partnerships, Microsoft’s decision to align directly with the industry highlights how deeply energy and technology are converging.

Microsoft is now scaling that vision with the construction of the world’s most powerful AI data center in Wisconsin, designed to deliver ten times the performance of today’s fastest supercomputers. Its growing nuclear alignment makes the direction clear: nuclear power is becoming the backbone of AI’s global infrastructure.

This year also marked uranium’s breakout moment, with spot prices hitting $82.63/lb in September and long-term contracts climbing to $83/lb, signaling renewed strength in the market. For investors, it’s another sign that uranium demand is entering a new long-term growth phase as the critical fuel powering nuclear reactors.

Behind uranium’s breakout lies a collision of powerful forces: supply cuts, soaring demand, and a global energy transition gaining unstoppable momentum. With production tightening and capital rushing into the sector, junior uranium exploration companies continue to behave like growth stocks.

While major producers are forced to scale back, these agile new explorers offer investors rare early exposure at bargain valuations and the potential to drive the next phase of nuclear-fueled growth.

How Microsoft’s Next Move Could Supercharge Uranium Demand

The World Nuclear Association (WNA) connects the global nuclear industry, uniting fuel suppliers, reactor developers, and policy leaders under one voice. It promotes nuclear energy as a pillar of sustainable development through research, advocacy, and global outreach. Among its members are leading innovators such as Constellation Energy Generation (NASDAQ: CEG), Rolls-Royce SMR (LSE: RR), Siemens Energy (NSE: SIEMENS), NexGen Energy (NYSE: NXE), Kairos Power, Mitsubishi (TSE: 7011), and now, Microsoft.

On the other side of the track, demand is accelerating. The World Nuclear Association projects that uranium requirements will rise 28% by 2030 and more than double by 2040, reaching over 150,000 metric tons a year compared to 67,000 in 2024.

Microsoft’s latest move adds a new dimension to the race, with its colossal Wisconsin facility highlighting how inseparable AI and energy have become. Projects of that scale demand continuous, carbon-free power, something only nuclear can reliably deliver. By joining the World Nuclear Association, Microsoft now stands at the crossroads of two unstoppable forces: the rise of AI and the nuclear revival powering it.

Uranium’s role in the future of the digital economy is practically guaranteed. The world’s leading companies are confirming nuclear power’s future, turning uranium into a necessity. Years of mine closures and export restrictions from Kazakhstan, the world’s largest uranium supplier, have left the global supply struggling to keep up with demand.

That’s why junior uranium miners present the strongest opportunity for investors: while major producers face limited output, juniors still trade at bargain prices with far greater upside as new production becomes essential.

Why Junior Miners Take the Lead in the New Energy Race

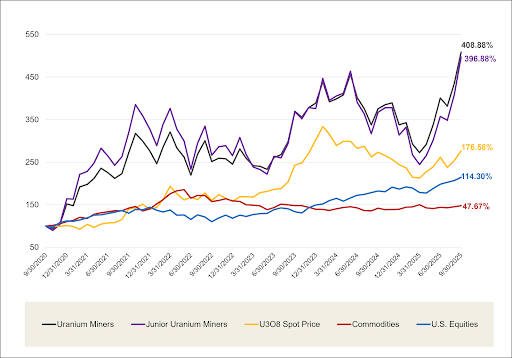

While majors struggle with production cuts and governments debate policy, investors have already spotted where the torque lies. In September, junior uranium miners rallied 21.75%, leaving majors and even broader equities in the dust.

Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years

This is no ordinary rally. The world’s largest uranium producer, Kazatomprom, has already announced a 10% production cut for 2026, sending a shockwave through supply projections. At the same time, expansion delays across the industry mean new reliable production is scarce. This shift shoves Canada—already the world’s second-largest uranium producer—right into the spotlight as utilities scramble for secure supply. A looming 10-year, US$2.8 billion uranium deal with India is just the opening shot in a much bigger demand wave for Canadian pounds.

But even with new contracts like this, supply is still nowhere near enough to satisfy long-term reactor needs. That widening gap is exactly where well-positioned junior uranium explorers can step in and potentially deliver outsized upside for early investors. Juniors are the dark horses of this race, small enough to be overlooked, but perfectly positioned to deliver new supply in regions like Canada’s Athabasca Basin, home to the highest-grade uranium deposits on Earth and some of the biggest uranium mines in the world.

These explorers represent rare early exposure to discoveries that could fuel the AI-driven nuclear renaissance. They are sitting on the front line of the most asymmetric energy opportunity of the decade. With uranium prices breaking out, supply shrinking, and demand doubling, junior uranium companies offer leverage that the giants simply can’t.

Disclaimer; TrueNorth News Inc., its employees, and its marketing partners have no stock, option, or similar derivative position in any of the companies mentioned, and have no plans to initiate any such positions. Past performance does not guarantee future results. Nothing in this material should be interpreted as a recommendation or advice that any specific security, portfolio, transaction, or investment strategy is suitable for any individual. This article was created and researched using artificial intelligence, using publicly available information. The author is not providing personal advice regarding the nature, potential, value, or suitability of any particular security or matter. You alone are responsible for determining whether any investment, security, strategy, product, or service is appropriate for your financial objectives and personal circumstances. Any views or opinions expressed herein may not reflect those of TrueNorth News Inc. as a whole. TrueNorth News Inc. is neither a licensed securities dealer, broker, U.S. investment adviser, nor an investment bank. These materials constitute sponsored content and do not represent a recommendation to buy or sell securities. TrueNorth News Inc. is in a marketing partnership with CIBIDI CORP., which is sponsoring this article on behalf of Kirkstone Metals Corp. CIBIDI CORP. has been retained and financially compensated by Kirkstone Metals Corp. to provide marketing and promotional services.