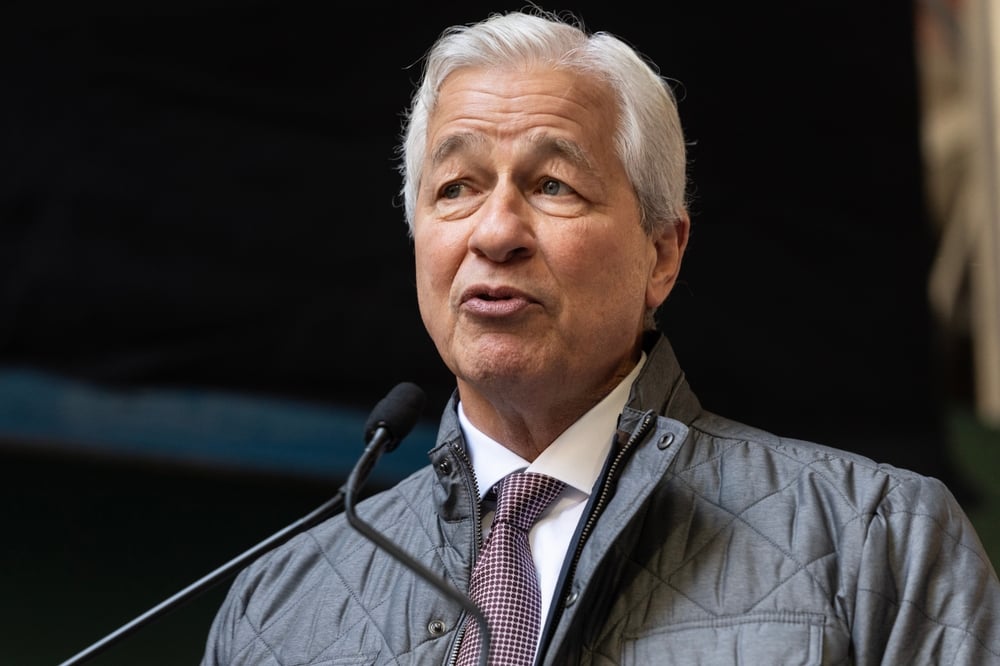

Wall Street titan Jamie Dimon expressed caution Thursday about the state of the U.S. economy, stating that a recession remains a serious possibility despite the recent rollback of tariffs on China. In an interview with Bloomberg Television, the JPMorgan Chase CEO emphasized that while a recession is not certain, it should not be ruled out at this point.

Recession Concerns Persist

Dimon acknowledged the uncertainty surrounding the possibility of a recession but underscored that it remains a real concern. “If there’s a recession, I don’t know how big it will be or how long it will last. Hopefully we’ll avoid it, but I wouldn’t take it off the table at this point,” he said. His comments came just days after the U.S. and China announced a 90-day tariff reduction deal, which some had hoped would help alleviate economic pressures.

Dimon Defers to JPMorgan’s Economists

In his interview, Dimon deferred to JPMorgan’s economists, who place the likelihood of a recession at close to a toss-up. Michael Feroli, JPMorgan’s chief U.S. economist, noted in a recent client note that while the odds of a recession remain elevated, they have dropped to below 50%—a slight improvement from previous forecasts.

Change in Outlook After Tariff Truce

Dimon’s comments marked a shift from his stance last month, when he suggested that a recession was likely. The recent 90-day tariff pause between the U.S. and China, coupled with the reduction of tariffs on other countries, has provided a degree of optimism, though Dimon remains cautious.

Uncertainty and Market Impact

Despite the tariff reductions, Dimon pointed out that the current level of tariffs on imports remains significantly higher than in previous years, and this could continue to cause economic damage. “Even at this level, you see people holding back on investment and thinking through what they want to do,” he stated. His comments reflect ongoing concerns that elevated import taxes may slow business investment and contribute to broader economic uncertainty.

Looking Ahead

While Dimon remains hopeful that the economy could avoid a full-blown recession, he emphasized the need for ongoing dialogue and engagement on trade policies to ensure that the U.S. economy remains on stable footing. The uncertain tariff landscape continues to be a key factor in shaping the outlook for economic growth in the near term.