The Consumer Financial Protection Bureau (CFPB) has introduced a significant reform to cap overdraft fees charged by banks and credit unions at $5, a sharp reduction from the typical $35. This move, announced Thursday, is projected to save consumers up to $5 billion annually, with households paying overdraft fees expected to save around $225 per year.

Under the new rule, banks may also choose alternative options, such as capping fees at cost levels or treating overdrafts like loans with transparent terms, including disclosed interest rates.

Part of a Broader Push Against “Junk Fees”

“For far too long, the largest banks have exploited a legal loophole that has drained billions of dollars from Americans’ deposit accounts,” said CFPB Director Rohit Chopra. He emphasized the bureau’s commitment to eliminating excessive charges and increasing transparency in banking services.

Lael Brainard, head of the National Economic Council, hailed the decision, calling it “real relief for families” burdened by excessive fees.

Industry Opposition Mounts

The banking industry has voiced strong objections. Rob Nichols, president and CEO of the American Bankers Association (ABA), argued that the rule imposes unfair price controls, potentially limiting the availability of essential banking services to consumers. Lindsey Johnson, president and CEO of the Consumer Bankers Association, criticized the CFPB’s actions as an overreach of its authority.

Implementation and Legal Hurdles

The rule is slated to take effect on October 1, 2025. However, legal and legislative challenges are anticipated, especially with President-elect Donald Trump set to take office.

“We expect legislative, regulatory, and legal challenges, with litigation being the most likely option to block the rule,” said Jaret Seiberg, financial services policy analyst at TD Cowen.

Despite these obstacles, Seiberg noted that the rule aligns with GOP populist views, potentially complicating opposition.

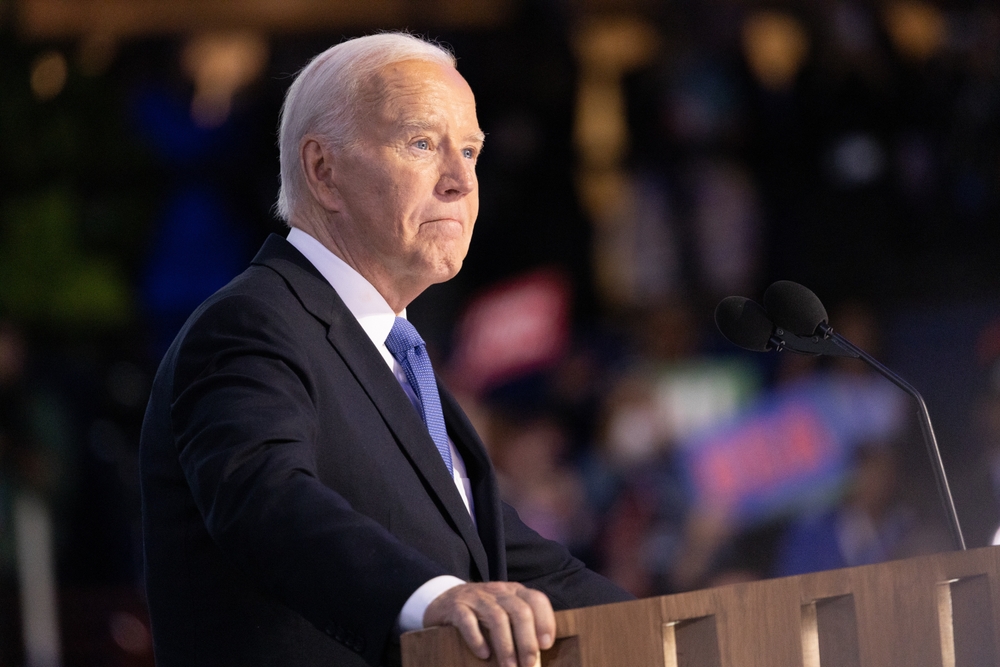

Part of Biden’s Broader Effort Against Hidden Fees

This move is part of the Biden administration’s wider campaign to address “junk fees” in various sectors, including airlines, hotels, and credit cards. Overdraft fees, imposed when a bank covers transactions for accounts lacking sufficient funds, have been a focus of these reforms.

The CFPB’s initiative reflects its broader mission of protecting consumers and reducing financial abuses. However, its success depends on navigating the complex political and legal landscape ahead.