After years of underinvestment, uranium is back at the center of the clean energy transition. Microsoft (NASDAQ: MSFT) has taken a clear step forward, becoming a member of the World Nuclear Association, the global organization that connects policymakers, utilities, and suppliers shaping the future of nuclear power.

Big Tech now sees nuclear energy as essential infrastructure for the AI era. While Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOG) are also pursuing nuclear partnerships, Microsoft’s decision to align directly with the industry highlights how deeply energy and technology are converging.

Microsoft is now scaling that vision with the construction of the world’s most powerful AI data center in Wisconsin, designed to deliver ten times the performance of today’s fastest supercomputers. Its growing nuclear alignment makes the direction clear: nuclear power is becoming the backbone of AI’s global infrastructure.

This year also marked uranium’s breakout moment, with spot prices hitting $82.63/lb in September and long-term contracts climbing to $83/lb, signaling renewed strength in the market. For investors, it’s another sign that uranium demand is entering a new long-term growth phase as the critical fuel powering nuclear reactors.

Behind uranium’s breakout lies a collision of powerful forces: supply cuts, soaring demand, and a global energy transition gaining unstoppable momentum. With production tightening and capital rushing into the sector, junior uranium exploration companies like Kirkstone Metals (TSX: KSM) continue to behave like growth stocks.

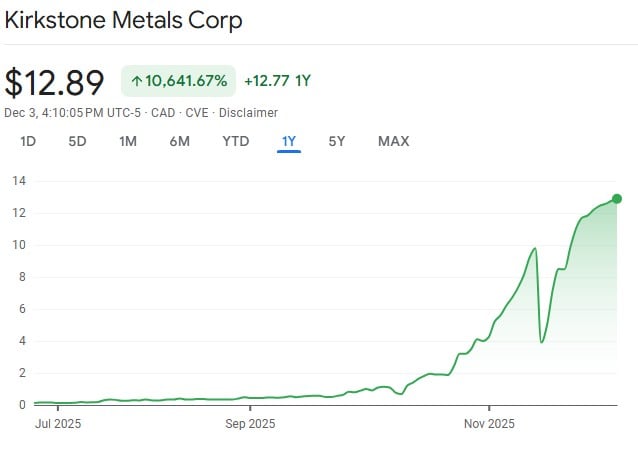

Kirkstone has secured 100% ownership of its Key Lake Road Uranium Project and kicked off Phase I of its exploration plan. This announcement comes just as its stock has already rocketed 10,641.67% since its late-May IPO, with uranium tailwinds that could push those gains into five digits. At the same time, management is weighing a secondary listing in Asia, targeting Hong Kong, aiming to stack another powerful growth catalyst right as the uranium market accelerates.

While major producers are forced to scale back, these agile new explorers like Kirkstone offer investors rare early exposure at bargain valuations and the potential to drive the next phase of nuclear-fueled growth.

How Microsoft’s Next Move Could Supercharge Uranium Demand

The World Nuclear Association (WNA) connects the global nuclear industry, uniting fuel suppliers, reactor developers, and policy leaders under one voice. It promotes nuclear energy as a pillar of sustainable development through research, advocacy, and global outreach. Among its members are leading innovators such as Constellation Energy Generation (NASDAQ: CEG), Rolls-Royce SMR (LSE: RR), Siemens Energy (NSE: SIEMENS), NexGen Energy (NYSE: NXE), Kairos Power, Mitsubishi (TSE: 7011), and now, Microsoft.

On the other side of the track, demand is accelerating. The World Nuclear Association projects that uranium requirements will rise 28% by 2030 and more than double by 2040, reaching over 150,000 metric tons a year compared to 67,000 in 2024.

Microsoft’s latest move adds a new dimension to the race, with its colossal Wisconsin facility highlighting how inseparable AI and energy have become. Projects of that scale demand continuous, carbon-free power, something only nuclear can reliably deliver. By joining the World Nuclear Association, Microsoft now stands at the crossroads of two unstoppable forces: the rise of AI and the nuclear revival powering it.

Uranium’s role in the future of the digital economy is practically guaranteed. The world’s leading companies are confirming nuclear power’s future, turning uranium into a necessity. Years of mine closures and export restrictions from Kazakhstan, the world’s largest uranium supplier, have left the global supply struggling to keep up with demand.

That’s why junior uranium miners like Kirkstone Metals (TSX: KSM) present the strongest opportunity for investors: while major producers face limited output, juniors still trade at bargain prices with far greater upside as new production becomes essential.

Why Junior Miners like Kirkstone Metals Take the Lead in the New Energy Race

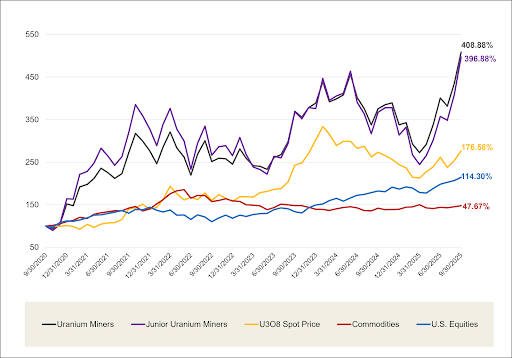

While majors struggle with production cuts and governments debate policy, investors have already spotted where the torque lies. In September, junior uranium miners rallied 21.75%, leaving majors and even broader equities in the dust.

Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years

This is no ordinary rally. The world’s largest uranium producer, Kazatomprom, has already announced a 10% production cut for 2026, sending a shockwave through supply projections. At the same time, expansion delays across the industry mean new reliable production is scarce. This shift shoves Canada—already the world’s second-largest uranium producer—right into the spotlight as utilities scramble for secure supply. A looming 10-year, US$2.8 billion uranium deal with India is just the opening shot in a much bigger demand wave for Canadian pounds.

But even with new contracts like this, supply is still nowhere near enough to satisfy long-term reactor needs. That widening gap is exactly where well-positioned junior uranium explorers can step in and potentially deliver outsized upside for early investors. Juniors are the dark horses of this race, small enough to be overlooked, but perfectly positioned to deliver new supply in regions like Canada’s Athabasca Basin, home to the highest-grade uranium deposits on Earth and some of the biggest uranium mines in the world.

These explorers represent rare early exposure to discoveries that could fuel the AI-driven nuclear renaissance. That’s why stocks from companies like Kirkstone Metals are rallying. They are sitting on the front line of the most asymmetric energy opportunity of the decade. With uranium prices breaking out, supply shrinking, and demand doubling, companies like Kirkstone offer leverage that the giants simply can’t.

After Soaring 10,641.67%, Kirkstone’s Next Rally Could Be Even Bigger

Few undervalued companies are better positioned to ride uranium’s new bull cycle than Kirkstone Metals (TSX: KSM). Based in Canada, the company is advancing projects near the Athabasca Basin, a region central to decades of nuclear growth. Its location gives Kirkstone an extraordinary head start in a race that’s only beginning.

At the core of its portfolio is the Gorilla Lake Uranium Project, covering 1,200 hectares in the heart of Saskatchewan’s prolific Athabasca Basin. Gorilla Lake sits in a proven uranium corridor surrounded by world-class deposits, giving Kirkstone a strategic foothold in one of the most productive regions for nuclear fuel on the planet. The Athabasca Basin hosts the highest-grade uranium on Earth and remains Canada’s main source of uranium production.

On top of Gorilla Lake, Kirkstone has secured 100% interest in the Key Lake Road Uranium Project in northern Saskatchewan and is preparing its initial exploration program there, adding a second catalyst in the same high-grade district.

Phase I at Key Lake Road starts with an induced polarization survey at the DD Zone, where past drilling has already confirmed anomalous uranium. The goal is to define structural targets for future drilling and open a second high-potential discovery path for Kirkstone.

In 2024, major producers in the Athabasca Basin delivered strong output. Cameco mined 23.4 million pounds from Cigar Lake and McArthur River. With large new projects like Rook 1 nearing final approval, the Athabasca Basin’s importance to future global supply keeps rising, making Kirkstone’s position in this district even more strategic.

Kirkstone Metals has already delivered what most juniors only promise: an 10,641.67% surge in value during its first explosive run. That rally proved two things: the market recognizes the company’s geological potential, and it’s capable of attracting serious investor attention when uranium sentiment turns bullish. Juniors positioned near advanced exploration or early development,like Kirkstone Metals, typically deliver the strongest torque when the market turns.

What makes this opportunity even more compelling is the asymmetry. Kirkstone Metals trades at a fraction of its peers despite operating in one of the world’s premier uranium belts. The fundamentals point to tightening supply, rising prices, and greater capital rotation into juniors. Kirkstone is also moving to broaden its reach by pursuing a potential secondary listing in Asia and has already retained Sidley Austin in Hong Kong to support an application for the HKEX, a step that strengthens access to international capital markets and aligns with Canada’s push to expand commercial ties across the region.

For investors, this is an early-stage position in the energy infrastructure that will power both the AI revolution and the nuclear renaissance.