China’s factory activity expanded for the second consecutive month in November, according to the National Bureau of Statistics. The purchasing managers’ index (PMI) rose to 50.3, a seven-month high, from 50.1 in October, surpassing forecasts of 50.2 in a Reuters poll.

The index remaining above the critical 50-point threshold signals growth, reflecting the impact of China’s recent stimulus measures trickling into the economy. However, new U.S. trade threats from President-elect Donald Trump pose potential challenges to this recovery.

Impact of Stimulus Measures

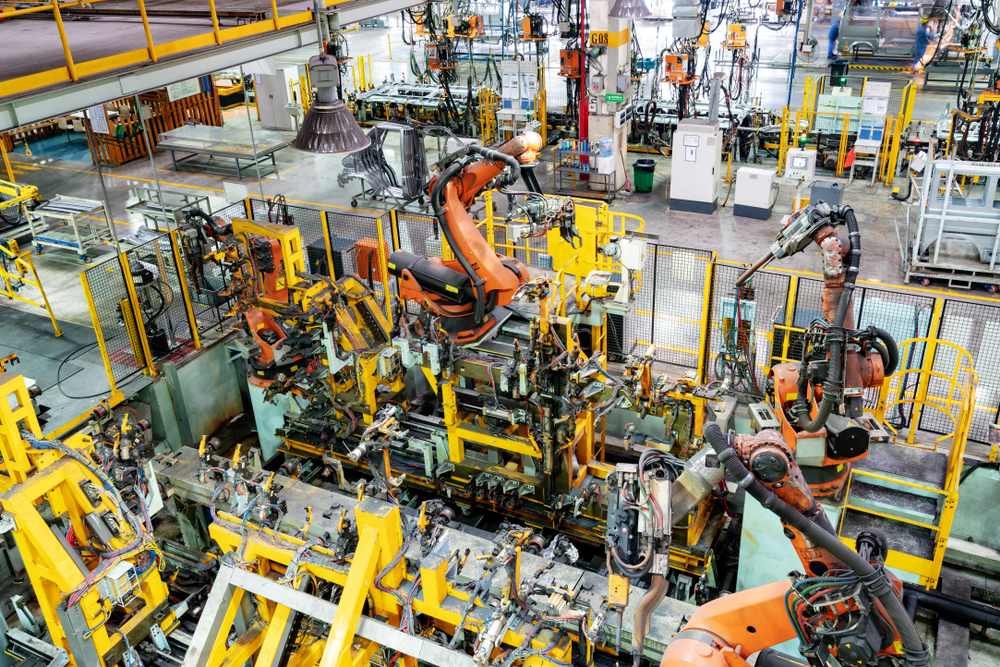

Two consecutive months of PMI growth suggest that China’s stimulus policies are beginning to stabilize its manufacturing sector, which has suffered from declining producer prices and reduced orders. Analysts believe these measures have started to restore business confidence, particularly in light of fiscal and monetary policies introduced after the September 26 Politburo meeting.

However, insufficient demand remains a key issue. According to Zhang Liqun of the China Logistics Information Center, it is critical for the government to bolster public investment to drive enterprise orders.

Trade War Looms

President-elect Trump has announced plans to impose a 10% tariff on Chinese goods to curb the flow of fentanyl-related chemicals into the U.S. He has also hinted at possible tariffs exceeding 60%, which could significantly disrupt China’s export-driven economy.

Analysts noted a surge in China’s exports in October as businesses rushed to ship goods ahead of anticipated U.S. and European tariffs. However, the uncertainty surrounding trade policies could delay corporate investment decisions and dampen growth in 2025.

Sector-Specific Performance

- Manufacturing: November saw total new orders expand for the first time in seven months, but export orders continued to decline for the seventh straight month.

- Services: The non-manufacturing PMI, which includes construction and services, fell to 50.0 in November, down from 50.2 in October, reflecting muted growth.

- Retail and Property: Retail sales grew at their fastest pace since February, and the slump in property sales narrowed, signaling potential recovery in these areas.

Economic Outlook

China recently announced a 10 trillion yuan ($1.38 trillion) debt package to address municipal financing pressures, alongside its largest central bank stimulus since the pandemic. Policymakers are expected to introduce further measures to maintain a growth target of 5% for 2025.

Challenges Ahead

Despite early signs of recovery, industrial output slowed in October, and industrial profits continued to decline, highlighting persistent profitability challenges. Analysts are also closely watching the private sector Caixin PMI, expected to edge up to 50.5 when released on Monday.

The composite PMI, which includes both manufacturing and services, remained at 50.8 in November, reflecting a fragile but ongoing stabilization in the economy.

China’s policymakers face the dual challenge of sustaining domestic demand while preparing for heightened trade tensions under the incoming U.S. administration.